At Acanthus we welcome the opportunity to work with ambitious private equity managers. We bring substantial value through high quality strategic advice, investment grade documentation work and deep access to relevant investor networks.

Years’ experience

0

+

Funds and transactions closed over the last 10 years

0

+

Euros raised in the last 5 Years

0

bn+

Why Acanthus?

Core European Mid-Market Specialism

We have a strong, continuous presence in the most challenging and dynamic segment of the European private equity market.

Corporate Finance driven approach

We build a deep, understanding of our clients' business and cultures to position every fund in a clear and differentiated manner.

Combined business model

We have a highly targeted approach to marketing and investor relations underpinned by strong relationships with the investor community

Partner-owned and driven

An independent, partner-owned business ensuring deep, long-term alignment with clients and investors alike

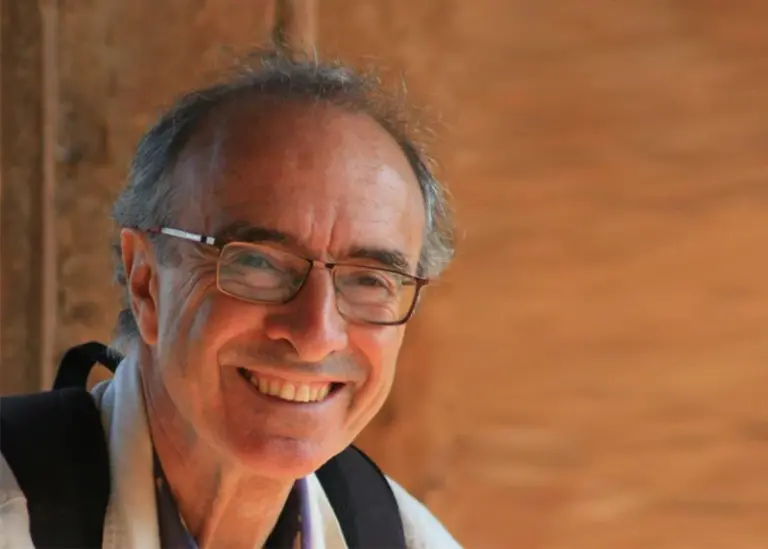

The team

Our team are dedicated corporate finance professionals, who approach every different mandate in a tailored and specific way.

Funds raised

Investors like working with us because of our highly relevant knowledge and our integrity

Preservation Capital Partners I

£309,000,000

July 2020

Crest Capital Partners II

€125,000,000

February 2021